is colorado a community property state death

The courts ability to divide marital property if a couple divorces does not impact a spouses ability to give away his share of. Inheritance of the community property depends on the survivors of the deceased spouse.

Colorado State Laws On Community Property When A Spouse Dies

Only nine states in the US.

. Some community property states have quasi-community property rules. While death is as certain as taxes it doesnt wipe out debts especially if you live in a community property state such as Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin community property law also applies in Alaska in certain circumstances. According to a certain states law a community property will be inherited by a surviving spouse if there are children in the marriage.

Colorado inheritance laws are designed to dig up a relative who could inherit your property. Marital and nonmarital property. It disregards their individual income or earnings.

Colorado inheritance laws are designed to dig up a relative who could inherit your property. When someone dies owning Colorado real estate a probate administration is necessary to transfer the property either to a buyer or to the estate beneficiaries. Quasi-community property is treated as community property when the couple moves into a community property state.

Unlike in community property states anything deemed to be marital property in Colorado is not assumed to be owned equally by both spouses and does not have to be divided equally in a divorce. In Colorado there is no assumption that property is divided equally. Generally both spouses can make an equal ownership claim to all income and assets acquired during the marriage.

The marital estate should be divided equitably between the spouses upon dissolution of marriage legal separation or annulment. Colorado law does not subscribe to the concept of community property. A non-probate asset is property of an estate that is not required to pass through the probate process or any similar to it.

Unlike the divorce process in community property states Colorados equitable distribution laws seek to divide property so as to be fair to both parties but not necessarily equal. If the property owner died while living out of state the type of probate proceeding necessary to transfer the Colorado real estate depends on. Marital property is to be divided equitably.

In these states a husband and wife are responsible. The short answer is no Colorado is not a community property state. Colorado doesnt recognize community property as its a separate property state.

Colorado is a marital property state not community property. People often ask. Quasi-community property is acquired by a couple living in a common-law state that would have been shared property if they were living in a community property state.

Community property law is a form of property ownership which dates back to the year 693 in Visigothic Spain. Is Colorado is a community property state. Apply community property laws to what is referred to as the marital estate The marital estate is a term used to describe all of the liabilities and assets tha If you are facing the possibility of divorce in Colorado you may feel overwhelmed by the emotional and financial challenges that come with such a major life change.

Colorado is not a community property state but it does have a category called marital property In Colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce. The nine states that DO have a community. Thus each spouse gets an equal division of marital assets in the event of death or divorce.

In addition to the above states Alaska is considered an opt-in state. November 14 2017. Does it mean equally 5050.

Instead Colorado courts divide the property of divorcing couples using a method called equitable distribution But what does that mean. Colorado is not a community property state but it does have a category called marital property in colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce. Colorado is an equitable distribution state which means property will be divided by the court in a manner that is deemed fair to both parties but not necessarily equal if spouses cannot come to a resolution on their own.

Inheritance of the community property depends on the survivors of the deceased spouse. Community Property Law vs. While nine states follow the community property rules above most states follow common law property rules.

There couples can agree to a division of property based on community property law even though the state as a whole isnt technically legally a community property state. Colorado is not a community property state but it does have. But should there be no one left to claim it it will escheat into the states hands.

That means that the assets and debts acquired during marriage ie. The Colorado UCDPRDA law provides that when one married person dies half of the marital property goes to the surviving spouse. However the Uniform Disposition of Community Property Rights at Death Act UDCPRDA was adopted by Colorado legislators in 1973.

The court will consider whether the property is marital or nonmarital. It assumes that spouses contribute equally to their marriage. Instead its divided equitably In many cases that means that whichever spouse earns more gets a larger share of the marital property in a divorce.

Is Colorado A Community Property State Death - It provides rules for disposing of property that was acquired as or from community property under the law of a state that recognizes community property. In a community property state the rules are different. Eleven states have adopted the uniform disposition of community.

So following that rule any bank accounts homes real estate vehicles or other assets that were accumulated during the marriage would belong to both spouses regardless of who actually. The law relating to inheritance of a community property on the death of a spouse varies from state to state. Separate property can become community property if its commingled in a joint account and cant be identified or its legal ownership status is changed to include a spouse in joint ownership.

Is Colorado A Community Property State Death Colorado is not a community property state but it does have a category called marital property in colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce. Is Colorado a dower state.

20 New Laws In Colorado Go Into Effect Friday Here S The List Subscriber Only Content Gazette Com

Colorado State Laws On Community Property When A Spouse Dies

Law Week Colorado Legal News In Denver And Across Colorado

Colorado State Laws On Community Property When A Spouse Dies

Ghost Bike Ghost Bike Roadside Memorial Modern Garden Design

Colorado Inheritance Laws What You Should Know Smartasset

Ghost Town Gallery Hundreds Of Pictures Of Ghost Towns In The American West

What Colorado Lawmakers Passed Amended Killed In Legislative Session S Final Days Colorado Newsline

Is Colorado A Community Property State Cordell Cordell

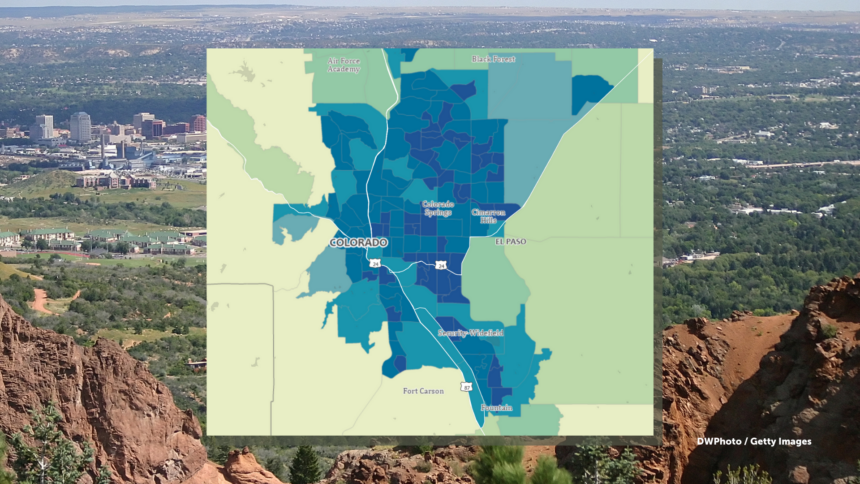

Data Says El Paso County Now Colorado S Most Populated Krdo

Colorado State Laws On Community Property When A Spouse Dies

Here S What You Should Know About Gun Laws In Colorado Colorado Newsline

Colorado State Laws On Community Property When A Spouse Dies

/cloudfront-us-east-1.images.arcpublishing.com/gray/X4VISVVDDNHIJJQEBSK5XGAIDE.jpg)

Proposal For Colorado S New Congressional Districts Released

What Is Common Law Marriage In Colorado Cls

Edward Marecak Judgement Of Paris Principles Of Art Figure Painting Judgement Of Paris

/Coloradoflag-Fotosearch-GettyImages-124279649-56acc76f3df78cf772b64e4e.jpg)